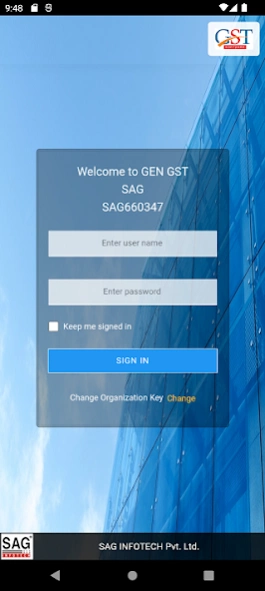

GEN GST Billing & e-Filing 5.5.8

Free Version

Publisher Description

GEN GST Billing & e-Filing - Install Free GST Billing & e-Filing app for invoicing and GST returns filing.

SAG Infotech has introduced its revolutionary Gen GST e-return filing and billing mobile app which provides solutions for all your GST problems in one place. Most of you already know that SAG Infotech is a leading tax software provider in India.

GSTR 1 - One-click e-filing of information with Offset & EVC/DSC-e-filing, delete all information from portal, summary/dashboard option, amendment facility, bulk download status of return filing.

GSTR 2A - Summary or dashboard option, download return data from the GSTN portal.

GSTR 3B - E-filing with offset and EVC/DSC of the returns with the import data facility from the government portal, summary/dashboard option, and bulk download status of filing details.

GSTR 4 - E-filing with Offset with auto offset, bulk download status of filing information, summary/dashboard option, download return data via the GSTN portal.

GST CMP 08 - E-filing of returns with EVC, filing status of the bulk download, summary/dashboard option, download return data from the GSTN portal.

GSTR 9

- One tap to prepare GSTR 9 from GSTR 1, 3B 2A & purchase register

- Reconcile tax data from the portal, accounting books & returns for matching

- Match data return-wise, invoice-wise, month wise & rate wise

- Import data from returns, Excel, JSON, etc.

- New Net Tax Liability report is incorporated in GSTR-9

GSTR 9C

- Create a GSTR 9C form to complete auditing

- Match all tax data and resolve errors before uploading

- Import/Export tax data, to/from Excel, JSON, etc

- E-file Through DSC/EVC

File the HSN Code

On the JSON file generation the input blank or 2 or 4-digit HSN code only, import the information in the Excel template of Government/SAG/Tally/Busy or Copy/Paste HSN.

Notification for the Match Mismatch Report

Compare the data of tax with every seller as per the enrollment information and during import from the govt database the Excel and via Gen GST.

Identification of an auto error

Find the error report Zip file and validate the GST numbers in bulk. With the distinct parameter validation of JSON files.

Reconciliation

1. Reconciliation of GSTR-3B with Input Credit Register

2. Reconciliation of GSTR-2A with Input Credit register for the assessing difference in ITC in GSTR-3B and GSTR-2A

3. Reconciliation of credit of GSTR-3B with GSTR-2A for match/mismatch

4. Reconciliation of GSTR-3B with GSTR-1

Get Actual Sales Amount Post Providing Amendment Effect

Report of purchase

Option to view GSTR-2A according to return, as per period i.e. monthly/Quarterly, etc. and supplier GSTN-wise with their Excel export

GEN GST Billing Software

This Gen E-invoice is capable of carrying out many e-invoice modules, allowing users to move through the e-invoice and invoicing process more quickly.

Gen GST is not only one of the greatest e-invoicing systems, but it can also be a powerful company management tool because the application furnishes-

• Platform independency

• Built using Java

• Sync facility is also available

• Secure mobile application

• Invoice (Sale) Goods and Services

• Billing of Goods and services

• Purchasing of invoices for unregistered dealers in the RCM system

Single or Bulk E-Invoice

You may produce single e-invoices in real-time input of vouchers as well as bulk e-invoices with a single tap.

Fast Invoice Generation

Gen GST permits you to generate e-invoices in one click.

E-Invoice Reporting

Businesses should save images of the invoices they generate, which the app allows them to do.

Creation of Masters

According to the requirements, the users can create masters

Digitally Signed Tax Invoices

You can quickly add your digital signature to tax invoices, supplier bills, and other data with our e-invoicing application.

GST E-Way Bill

Because the app is connected with the E-way bill module, users may produce E-waybills directly using E-invoicing.

About GEN GST Billing & e-Filing

GEN GST Billing & e-Filing is a free app for Android published in the PIMS & Calendars list of apps, part of Business.

The company that develops GEN GST Billing & e-Filing is SAG INFOTECH PVT LTD. The latest version released by its developer is 5.5.8.

To install GEN GST Billing & e-Filing on your Android device, just click the green Continue To App button above to start the installation process. The app is listed on our website since 2023-07-06 and was downloaded 47 times. We have already checked if the download link is safe, however for your own protection we recommend that you scan the downloaded app with your antivirus. Your antivirus may detect the GEN GST Billing & e-Filing as malware as malware if the download link to sag.com.portal is broken.

How to install GEN GST Billing & e-Filing on your Android device:

- Click on the Continue To App button on our website. This will redirect you to Google Play.

- Once the GEN GST Billing & e-Filing is shown in the Google Play listing of your Android device, you can start its download and installation. Tap on the Install button located below the search bar and to the right of the app icon.

- A pop-up window with the permissions required by GEN GST Billing & e-Filing will be shown. Click on Accept to continue the process.

- GEN GST Billing & e-Filing will be downloaded onto your device, displaying a progress. Once the download completes, the installation will start and you'll get a notification after the installation is finished.